Highlights

- US stocks derive tremendous value from being domiciled in one of the most predictable and liquid capital markets.

- The erosion of rule of law and explosion in uncertainty could lower the premium investors are ready to pay for those stocks.

- US stocks just saw the second-largest Q1 outflow from global institutional investors since 1999

Over the past 15 years, the US stock market has benefited from being domiciled in one of the safest (for capital), most predictable, most economically stable and most shareholder-friendly countries in the world. But nothing lasts forever. The second Trump presidency has already weakened central tenets of “American exceptionalism”. Can the US remain the dream home for global capital?

The Trump administration has gnawed at the attractiveness of US capital markets from many angles. The new executive team has:

- Generated economic uncertainty out of thin air by imposing, then postponing, then reimposing, trade tariffs on allies.

- Made US-based companies into potential targets for foreign retaliation.

- Hurt allies’ perception of US capital safety by sabre-rattling in the direction of Greenland and Canada.

- Eroded the competency and independence of agencies and regulators by unsystematically firing government employees.

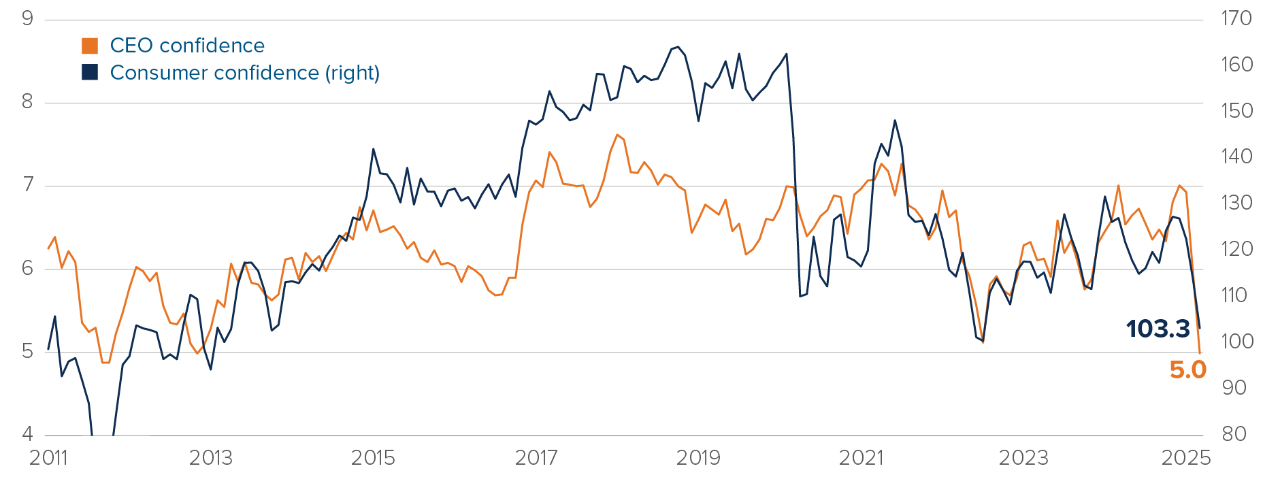

Consumer confidence has dipped in recent months, and in March a gauge of confidence among CEOs had its largest monthly decline since 2008. Trump and his team have explicitly stated that they do not care about short-term economic performance. In their view, Americans should expect some economic pain, a necessary step to rebalancing the economy towards a more sustainable path. Clearly, firms don’t like economic pain, as short-lived as it might allegedly be.

Confidence is a self-fulfilling prophecy

US confidence indices

Source: Bloomberg. Consumer confidence is an average of measures by the University of Michigan and the Conference Board, rebased to 100 in 2002. CEO confidence is a measure from Chief Executive, which polls CEOs about their expectation of the economy one year from now.

Source: Bloomberg. Consumer confidence is an average of measures by the University of Michigan and the Conference Board, rebased to 100 in 2002. CEO confidence is a measure from Chief Executive, which polls CEOs about their expectation of the economy one year from now.

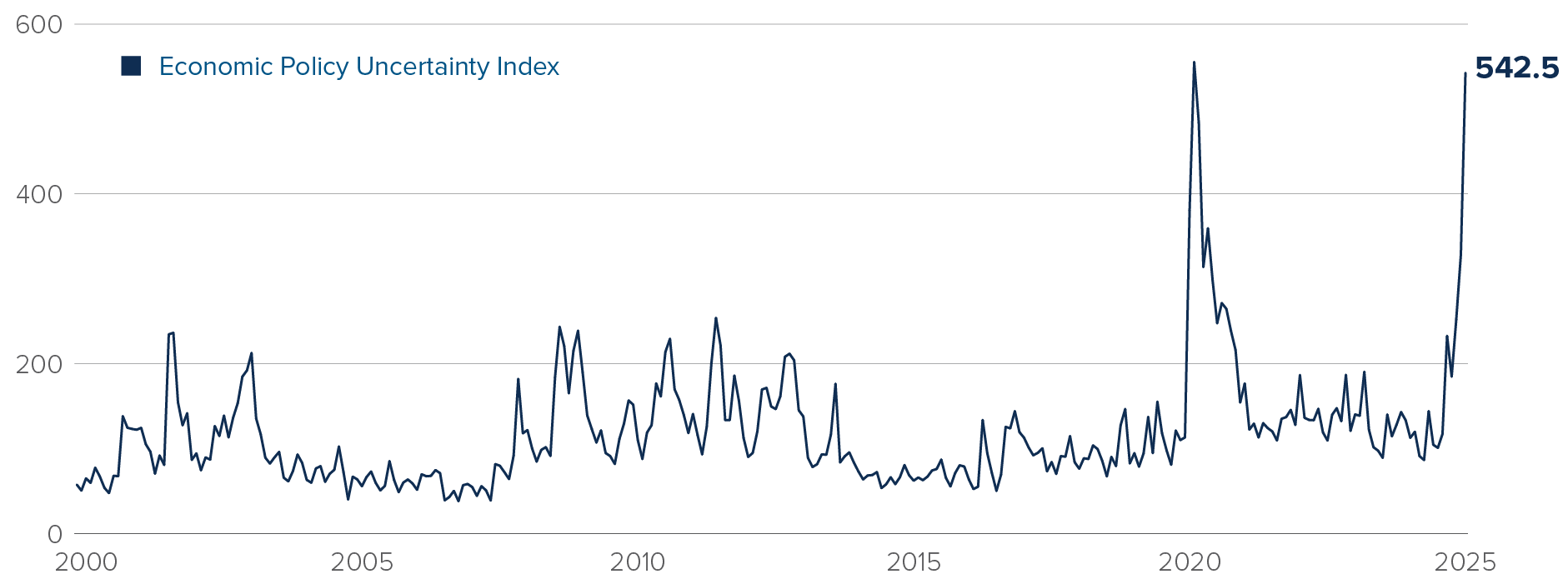

By most measures, US economic uncertainty has hit its highest level since 2020. Typically, economic uncertainty gauges are highest when the economy is in a crisis — recession, pandemic, financial crisis, war. It is highly unusual to see such high readings when current economic conditions are… fine? From an economist’s perspective, this is the purest form of uncertainty: firms are paralyzed because they have no clue what to expect from the future. We are not in a recession. Most companies won’t layoff workers, default on their debt or slash prices. But they’ll probably stop investing and innovating.

When unpredictability is seen as a virtue

US economic policy uncertainty index

Source: Bloomberg, Baker, Bloom & Davis. 100 is the long-term average. The chart shows a monthly average of the daily measure.

Source: Bloomberg, Baker, Bloom & Davis. 100 is the long-term average. The chart shows a monthly average of the daily measure.

The S&P 500 has crushed global peers over the past 15 years mainly because of the sheer dominance of the US’s most innovative and profitable companies. But there’s another layer here: valuations are elevated in part because global capital feels safe in the US. Given a choice between equally profitable and innovative firms, an investor in, say, Japan, is ready to pay a higher price for the one listed in the US, than for a similar company in France, Germany or Korea. US-listed companies today make up more than half of the MSCI All-Country World Index partly because investors are ready to pay a premium for US companies.

Could this premium evaporate? Could American exceptionalism get eroded to the point where an investor would be ready to pay the same price for an American company as for, say, a British company? Probably not. The US will remain the world’s largest, most innovative economy, boasting highly liquid financial markets, even if the current administration persists on its destabilizing policy path. But could the premium erode a bit? It’s not impossible.

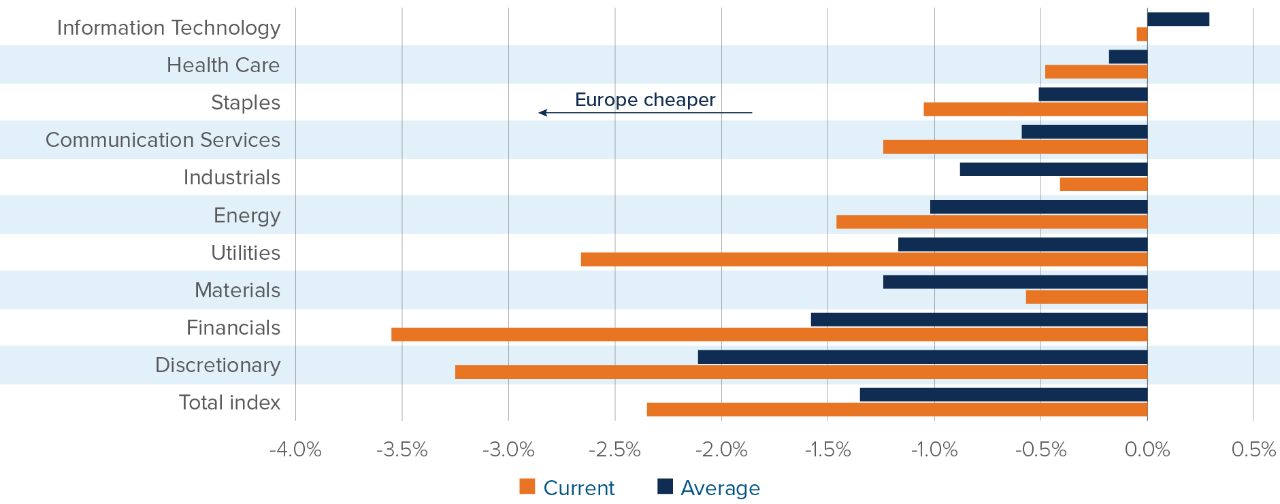

For large-cap US stocks, the luster is wearing off just as prices are getting stretched. Stock valuations in the US are not at an extreme. This is not 1999. But they are a bit expensive, both in absolute terms and relative to other markets. Even when adjusting for different sector exposures — it is normal that an investor would pay more for a tech stock than a utilities stock — US equities are more expensive than most international markets. For example, European stocks are significantly cheaper than US stocks, even after outperforming US stocks by 10% in the first quarter of 2025.

European stocks still cheaper after recent rally

Earnings yield, US minus European stocks, today vs. average

Source: Bloomberg. The chart compares the earnings yield on the MSCI US and MSCI Europe indices, by sector, and overall. The data starts in 1995.

Source: Bloomberg. The chart compares the earnings yield on the MSCI US and MSCI Europe indices, by sector, and overall. The data starts in 1995.

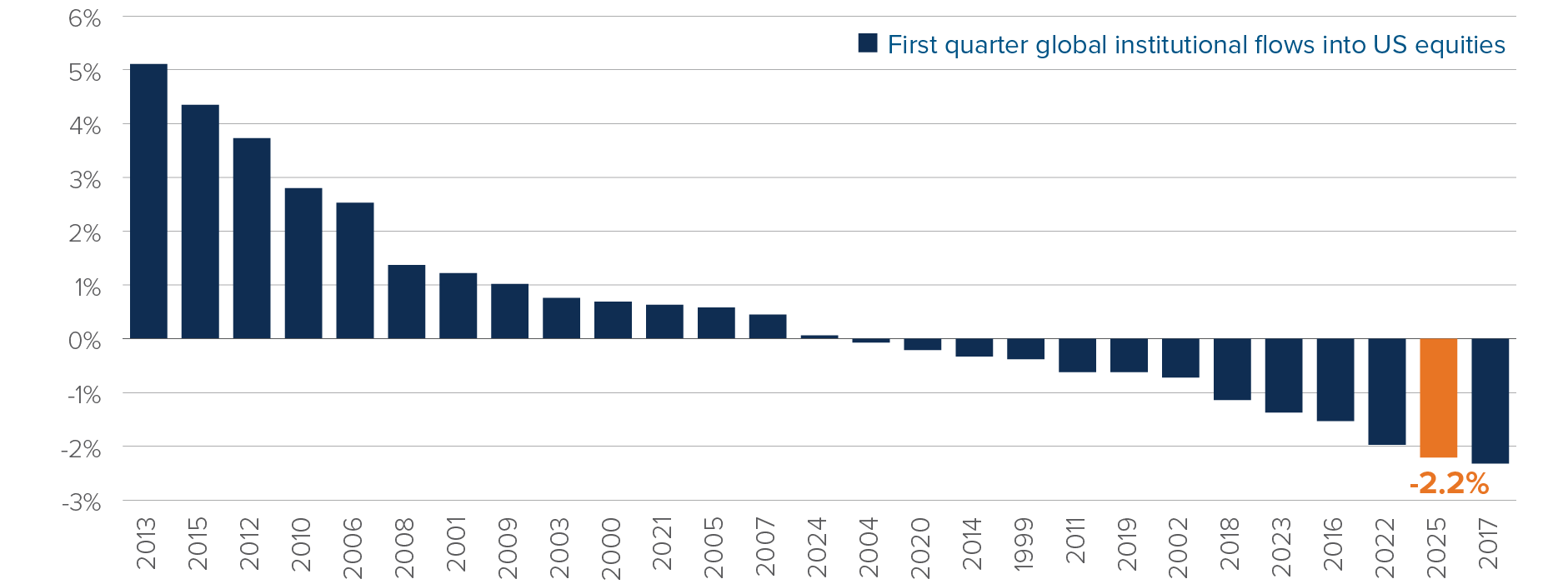

There is some weak evidence that sophisticated investors have sold US equities in 2025. We just saw the second-largest outflow from US stocks from global institutional investors in a first quarter since 1999.

Global investors shunned New York in Q1

Cross-border flows into US equities, institutions, first quarter flows

Source: StateStreet.

Source: StateStreet.

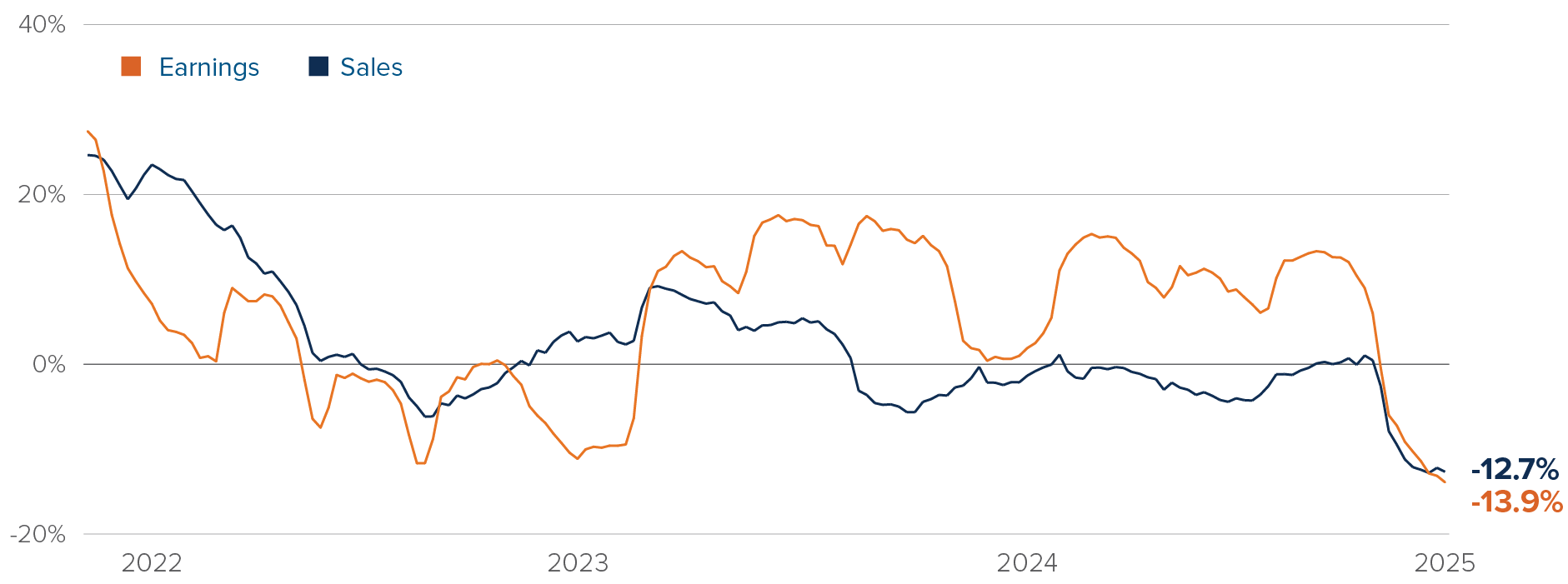

Analysts have also slightly soured on large-cap US companies. Nearly two-thirds of S&P 500 companies had their end-2025 earnings forecasts cut in the first quarter. Sales estimates took a similar hit. We’re far from a recession scare, but the current downward revision impulse is the largest since 2020.

Deteriorating prospects for US companies to start 2025

Net positive revisions to current year fundamentals in past three months, S&P 500

Source: Factset. The chart shows the percentage of positive revisions to fundamentals by the analysts covered by Factset. A 0% reading indicates that exactly half of S&P 500 companies saw their year-end earnings or sales forecasts get revised up over the past three months.

Source: Factset. The chart shows the percentage of positive revisions to fundamentals by the analysts covered by Factset. A 0% reading indicates that exactly half of S&P 500 companies saw their year-end earnings or sales forecasts get revised up over the past three months.

US equities derive tremendous value from the economic and political environment they exist in. An erosion of rule of law wouldn’t erase the profitability of world-beating US companies. But it could lower the premium investors are ready to pay for those companies. The US is a dream house for capital. If foreign investors snap out of this dream, other global markets could suddenly become more attractive at current prices.

Multi-Asset Strategies Team’s investment views

Tactical summary

Source: Mackenzie Investments.

Note: The opinions expressed in this piece reflect short-term tactical views, which inform the positioning of some of the funds managed by the Multi-Asset Strategies Team.

Source: Mackenzie Investments.

Note: The opinions expressed in this piece reflect short-term tactical views, which inform the positioning of some of the funds managed by the Multi-Asset Strategies Team.

Positioning highlights

Neutral on duration: Our bond exposure peaked in early January, but after a rally in bonds driven mainly by weak US growth data, we are back down across the threshold to neutral in our positioning. Trump’s economic policies — government job cuts, trade wars, general uncertainty — will weigh on economic growth, but much of that effect has been priced in, with markets now expecting three Federal Reserve cuts this year. Trade tariffs will cause prices to jump in the US but are not an inflationary shock. Once the one-time effect on prices has passed, future inflation could be lower than without the tariffs, given trade wars could depress economic growth.

Overbought global stocks: We are bearish global equities for the third month in a row, after stock market gains — without a coincident improvement in fundamentals — finally brought valuations to overbought levels. We still think global economic growth will be fine and tariffs won’t force central banks to raise rates. But the growth in sales and profit margins required to justify current valuations is too ambitious for our taste.

US stocks running out of steam: After a historic run, US stocks have seemingly run out of steam. Their valuations are not at extreme levels, but they are pricier than most other equity markets globally — Canada excluded, notably. Plus, sentiment has recently shifted against US stocks: informed investors have been slowly turning away from the market since the end of 2024. Finally, earnings and sales revisions for the S&P 500 have turned sharply lower in recent weeks. International equities offer a more attractive risk-return trade-off in our view.

Canadian landing: After having an argument for the most disappointing advanced economy last year, Canada saw its economic data solidify in recent months. In a world without a trade war with the US, Canada’s growth slump would be receding, the job market would be on a durable uptrend and the Bank of Canada might be done cutting rates. But that is not the cruel world we live in. In our view, the US will maintain tariff pressure on Canada throughout the next few quarters. The Canadian dollar will have to weaken even further to help the economy absorb the heavy blow of tariffs.

Defensive sectors shine bright: We generally like the defensive sectors of the S&P 500, including consumer staples, health care and real estate. They have attractive valuations after a few years of underperforming the broad index, and would benefit from the elevated macro uncertainty and slowing economic growth we expect for the coming months.