Fixed income investing relies on adeptly managing two primary risks: interest rate fluctuations and credit exposure. Traditionally credit risk has been mitigated through rigorous fundamental analysis of cash flows — a cornerstone of portfolio management. Yet, as evidenced by past risk-off periods, this approach alone can prove insufficient when markets face abrupt dislocations. Sharp spikes in credit spreads and heightened volatility have, at times, overwhelmed conventional strategies, exposing portfolios to significant downside risk.

Put option strategies in fixed income funds offer a nuanced approach to portfolio management, with downside protection allowing for potential enhanced returns in specific market conditions. By incorporating put options, investors can hedge against interest rate volatility, credit spread widening or declining bond prices, providing a safety net that traditional fixed income allocations might lack. However, this strategy is not without trade-offs — while it can mitigate losses during turbulent periods, it often comes at the cost of reduced yield in stable or rising markets, as premiums paid for the options erode returns. Understanding the mechanics of put strategies, along with their benefits and limitations, is crucial for investors aiming to balance risk and reward effectively.

Evolution of hedging strategies within Mackenzie’s Unconstrained Strategy:

In line with the Mackenzie Unconstrained Fixed Income Fund’s and Mackenzie Unconstrained Bond ETF (MUB) strategy to reduce overall portfolio volatility and provide investors with a more diversified experience, the Unconstrained execution has transitioned from a high yield tilt in 2014 to a high-quality multi-sector mandate since 2017. The fund’s “always on” strategy to hedge high yield exposure has evolved from outright put options to bear put spreads and the availability of a diverse tool kit of hedging instruments, spanning from put options on HYG ETF, S&P 500, CDS and VIX (in transit). This evolution has enabled the fund to reduce overall costs while capturing upside potential.

Protected high yield strategy

- The combination of points 2 and 3 is called a “bear put spread”.

- The combination of our high yield bond holdings and the associated put protection enables our mandate to still collect attractive net yields, participate in the market upside, but also insulate the mandate from market volatility and tail risk scenarios that might occur in risk off market environments.

Selection process:

The selection of hedging instruments and their integration into the mandate hinges on a critical question: what is the most effective way to hedge tail risk in the current environment? This decision unfolds through a two-part process. The first step involves pinpointing the primary risk — whether it’s rising junk bond yields (duration risk), widening credit spreads (credit risk), or a combination of both. For instance, in periods where yields threaten to climb and depress prices, as seen in March 2020, HYG put options proved effective, capturing both the duration and credit risks embedded in high-yield bond indices. In contrast, today’s environment of historically tight spreads shifts the focus to protecting against spread widening, irrespective of yield direction.

Most effective put option strategies across market environments |

||

Higher yields |

Spread widening |

|

Higher yields |

HYG ETF |

HYG ETF / CDX |

Spread widening |

HYG ETF / CDX |

CDX |

Higher volatility |

VIX |

VIX |

Correction in risk assets |

S&P 500 |

S&P 500 |

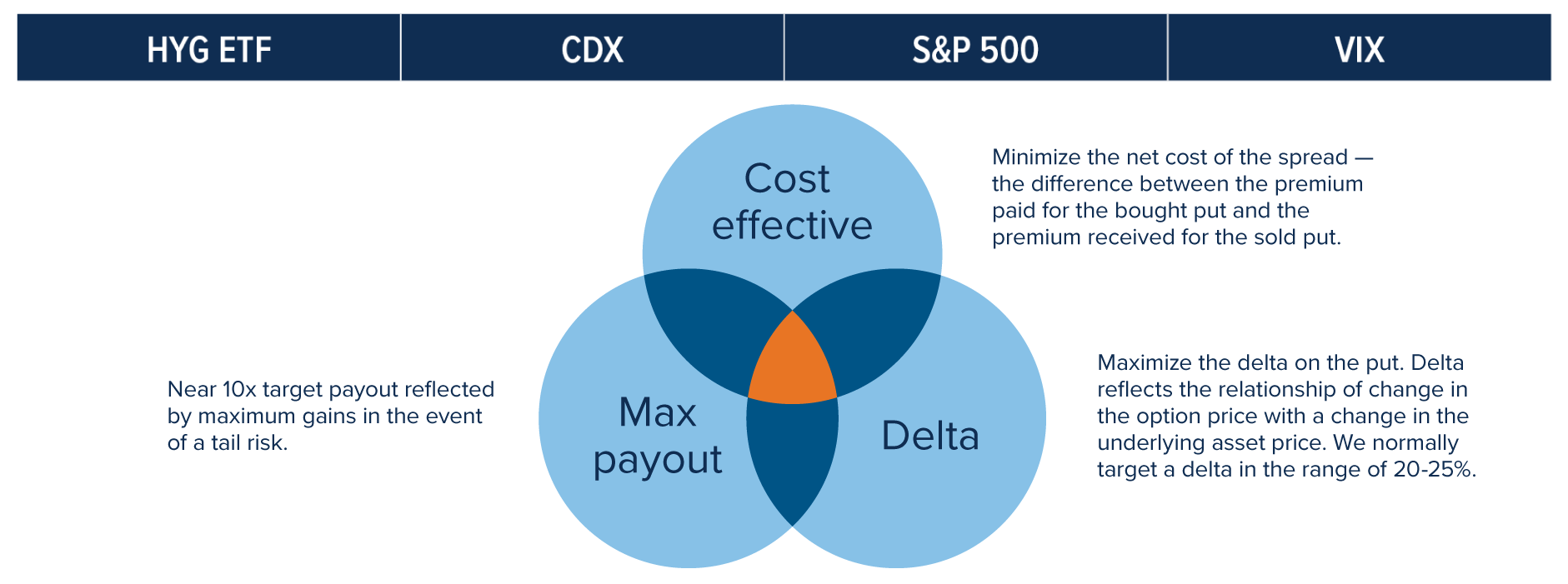

The second step is the strategic selection of contracts, a blend of art and science. Here, the goal is to identify a sweet spot — options with a target delta range that maximizes payout in a risk-off event while remaining cost-efficient. This involves evaluating an array of payer spread options, testing various permutations and soliciting quotes from multiple large banks to secure the most competitive pricing. To maintain flexibility and coverage, we implement a laddered approach, deploying three-month hedges rolled monthly.

Primary objective: Tail risk hedging

Current hedge positioning:

Our current positioning reflects a deliberate blend of outright puts on the payer spread CDX options (80%) and HYG ETF (20%), tailored to address the prevailing risk of spread widening over directional yield movements. CDX options underpin this approach, enabling the purchase or sale of credit default swap protection on a reference entity at a fixed spread for a future date. Our tilt towards CDX payer spreads underscores our view of today’s market, where credit spread widening poses a greater threat than yield fluctuations. This positioning aligns with our two-part selection process — identifying the dominant risk and optimizing for cost-effective, delta-targeted contracts — while remaining agnostic to the specific instrument, so long as it meets these criteria. Historically, this strategy has proven its resilience, aiming to minimize downside capture for our investors during periods of unprecedented volatility. That said, its robustness demands vigilant oversight of option costs and market dynamics to guard against the pitfalls of over-hedging.

As of April 30, 2025

As of April 30, 2025

*Since Inception date: Mackenzie Unconstrained Fixed Income Fund F - December 3, 2014, Mackenzie Unconstrained Bond ETF (MUB) - April 19, 2016.

The Mackenzie Unconstrained Fixed Income Fund and Mackenzie Unconstrained Bond ETF are designed and managed to provide access to an all-weather strategy, with robust downside protection that aims to safeguard investor assets during periods of heightened volatility.

To learn more about Mackenzie’s Unconstrained strategy, speak to your Mackenzie Sales team.

Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments and Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of April 30, 2025 including changes in share or unit value and reinvestment of all dividends or distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds and Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.