Written by the Mackenzie Fixed Income Team

Key Highlights

- Tariffs, immigration, and deregulation in the financial and energy sectors are expected to drive markets into the first quarter of 2025 and beyond.

- 2025 is expected to be a particularly challenging year for Federal Reserve decisions. Current market pricing anticipates 40 basis points of easing throughout 2025 with a rate "skip" at the January FOMC meeting appears almost certain.

- Canadian assets are at significant risk under the new Trump administration, therefore the market pricing for the Bank of Canada terminal policy rate appears underpriced.

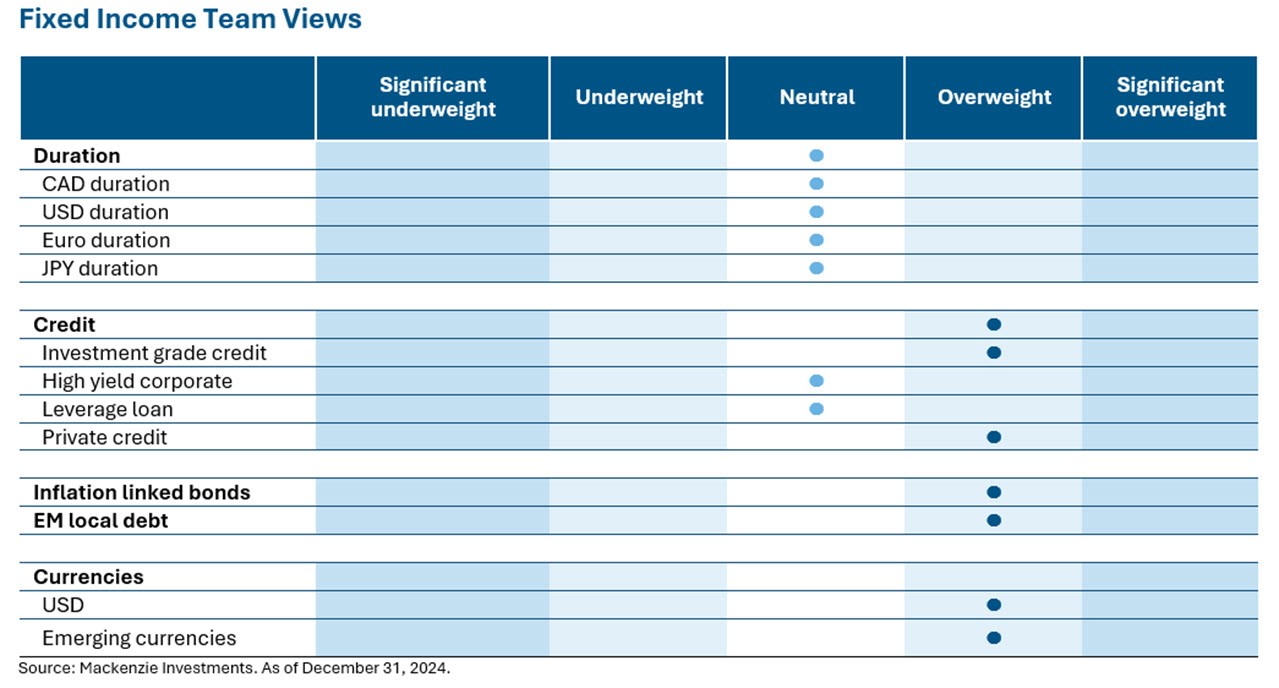

- Prefer high-grade Canadian corporate bonds at the short end of the yield curve. The team remains cautious on long-duration bonds, expecting yields to rise long term due to an improved US economic outlook.

- Brazil and Mexico face rising risks and diminished appeal due to inflation, political instability, and falling oil prices, while Indonesia and South Africa offer more attractive investment opportunities.

Duration and Curve Positioning

As we enter the new year, several key themes are expected to influence markets into the first quarter of 2025 and beyond. Tariffs, or the threat thereof, continue to dominate policy discussions, alongside immigration and deregulation in the financial and energy sectors. The recent rise in yields has reached a level where further increases could negatively impact valuations of higher beta assets, raising the likelihood of a cross-asset correction. We have long anticipated increased cross-asset volatility, and this trend appears set to continue. Canadian assets face significant risks under the new Trump administration, with discussions of a "51st state" and "economic warfare" heightening concerns. Canada's political situation exacerbates these risks, particularly with the prorogation of parliament delaying critical legislation, including a $1.3 billion border security bill. This delay increases the likelihood of tariff threats or implementations, with no resolution on the Canadian border security front expected before late March. A 10% across-the-board tariff on Canadian goods imported into the US could reduce Canada's real GDP by approximately 1% in the first year. A 20-25% tariff would likely trigger a recession, given the current economic conditions. Market pricing for the Bank of Canada at 60 basis points for 2025 appears underpriced, and we anticipate the policy rate could drop to 2.25% or lower, significantly below current pricing. Brazil’s appeal has diminished due to rising inflationary pressures and political instability, while Mexico’s outlook has been dampened by domestic political uncertainties, falling oil prices, and potential shifts in US trade and immigration policies. Both countries, once market favorites, now carry elevated risk premiums that are unlikely to ease in the near term, in our view. Conversely, Indonesia’s local government bonds and South African debt remain attractive. Indonesia offers higher yields, while South Africa benefits from an advanced disinflation process that strengthens the South African Reserve Bank’s capacity to ease policy.

This greater focus on debt and political stability is likely to continue into 2025, as will the extent of dispersion between the US, euro zone and Japan. For investors, this is likely to impart both rate and currency volatility to what has otherwise become a more attractive carry trade environment.

Central Bank Watch

US Fed (Fed)

The FOMC cut the policy rate by 25 basis points to 4.25%-4.50% at the December meeting, a widely anticipated move. The updated dot plot revealed a more gradual and shallower path for future rate cuts, with the median official projecting a fed funds rate of 3.9% by the end of 2025 (vs. 3.4% in Sep. dot plot), implying 50 bps of rate cuts in 2025 (vs. 100 bps previously). Bond yields continued to rip higher ending near the highs in the 1st half of the year. Bonds remain offered – yields higher, prices lower – led by stronger economic data, stalling progress on inflation with risk of moving higher due to tariffs, warranting lower rate cuts than previously anticipated. Fiscal worries of extra debt issuance needed to fund the U.S. government's expanding budget deficit have also recently weighed on fixed-income investors' confidence.

Bank of Canada (BoC)

The central bank continued with its monetary easing with an outsized 50 bps of rate cut at 3.25%, reaching the top of the neutral policy rate of 2.25-3.25%. Being one of the most aggressive rate-cutters, the move lower was justified by headline inflation within the target range of 1-3% and an elevated unemployment rate rising to 6.8% for November. With such swift moves, BoC’s policy rate is now 125 basis points below the upper bound of the Federal Reserve rate — a key reason for recent weakness in the Canadian dollar. Bond yields were higher in correlation to higher yields in the US and tariff threats building concerns over higher inflation in the future.

European Central Bank (ECB)

The ECB cut interest rates for the fourth time this year by 25 bps, as expected, bringing the deposit rate to 3.00% in December. The ECB reduced growth and inflation forecasts paving the way for further interest-rate reductions in 2025. Although the threat of inflation persists, the likelihood of a recession is increasing due to political instability in France and Germany, as well as potential U.S. tariffs on European exports. Investors now anticipate that the ECB to reduce interest rates much more aggressively than the Fed or the Bank of England in the coming months, with terminal rate expectation around 1.75%.

Bank of Japan (BoJ)

The yield on Japan's 10 year government bonds surged to a 13-year high of 1.11%, reflecting market expectations of a future rate hike by the BOJ. Concurrently, the yen weakened to 157.20 against the dollar, its lowest since July. Despite speculation, BOJ Governor Kazuo Ueda has not provided a clear timeline for the next rate hike, stating he will monitor economic conditions. The market currently sees a 40% chance of a rate hike in January and a 70% chance by March, based on overnight-indexed swaps.

Emerging Markets (EM)

The EM environment continued to remain volatile as it battles not only from its domestic issues around budget deficits but also uncertainty in navigating Trump’s potential economic and geopolitical policies and Fed’s rate expectations. Brazil government bonds and currency continue its relentless sell off disconnected from peers driven by lack of commitment from President Lula to fixing a growing budget deficit. The central bank took an extreme hawkish stance by raising rates by 100 bps to 12.25% pledging to hike by another 100 bps each in its’s January & March meeting. Mexico cut interest rates by 25 bps to 10% for fourth straight meeting as inflation trends back to target and the economy losing momentum. Banxico noted that potential new tariffs have added uncertainty to its inflation forecast, leading to an upward revision starting in Q2 next year. Peso weakened in December and closed weaker by 23% for the year vs USD, worst annual performance since 2008.

Credit Market Performance

Investment Grade Credit (IG)

Corporate bond yields in the US rose in line with the move in rates, however impact was muted in Canada. The IG bond yield was higher by 27 bps at 5.36% and returned -1.78% for the month vs. a return of -0.14% for Canadian bonds. The diversion reflects the recalibration of policy rate expectations higher even as the Fed cut rates in its December meeting. We continue to find value and prefer our exposure in the front end of the Canadian corporate bonds.

High Yield Bonds (HY)

HY bond yield and spread rose 31bp and 12 bp in December to 7.47% and 310 bps, respectively, which were 23 bps and 53 bps lower in 2024. The HY bonds returned -0.43% loss in December with CCCs (+0.22%) outperforming Single Bs (-0.29%) and BBs (-0.66%). Bond yields surged in line with the treasuries as the Fed delivered a hawkish cut amid a combination of firmer growth and inflation data. The HY index is providing a gain of +8.20% in FY24 with CCCs (+18.31%) outperforming Single Bs (+8.04%) and BBs (+6.56%).

Leveraged Loans (LL)

The US leveraged loan market closed 2024 with several record-breaking achievements. Despite a dip in secondary prices in December, carry was the main driver of returns. The US Loan Index rose by 0.57% in December (price return -0.13%, coupon +0.70%). The rate cuts brought the secondary YTM on index-tracked loans to 8.55% on Dec. 31, the lowest since September 2022, down 18 bps from November. Loan yields over 150 bps throughout 2024. While yields dropped from the double-digit levels seen in most of 2023, they remain highly attractive compared to pre-rate-hike levels.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of December 31, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.