Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

The Mackenzie Betterworld Global Equity Fund slightly underperformed its new benchmark (MSCI World ex Fossil Fuels Index) for the month. Stock selection in health care and technology detracted the most from portfolio performance. Elevance Health (down 19.49% for the month), a US-based managed care provider, reported weak Q3 results (similar to its competitors) which prompted guidance cuts for 2024/25. AstraZeneca (down 5.76%) declined amid investigations of insurance fraud by Chinese authorities, relating to lung cancer drug prescriptions. The Betterworld team has placed the company under review for an ESG thesis check. Stock selection in materials contributed to portfolio performance for the month. Notably, CRH PLC, a construction materials firm, was up +6.18%. With over 70% of its business being generated from North America, CRH remains well positioned to benefit from infrastructure and non-residential construction in the region. Following solid Q3 earnings, the outlook for 2025 highlights continued volume and pricing strength across the Americas and Europe. This outlook supports double digit EBITDA growth for the construction materials firm and multiple re-rating potential.

The Mackenzie Betterworld Canadian Equity Fund underperformed its new benchmark (S&P/TSX Composite Fossil Fuel Reserves Free Index) in October. Stock selection in financials and industrials contributed positively to the fund’s performance. Within financials, the team’s decision to exit its position in TD (down 8.73% for the month) in early 2024, due to ESG-related factors, contributed to performance. Within industrials, AtkinsRealis (+21.93) contributed to portfolio performance. As the sole licensee of Canada's CANDU Nuclear reactor technology, which is 1 of 6 approved/proven large reaction technologies globally, the company’s nuclear business remains well positioned.

Exits and Additions

- As part of its ongoing monitoring of ESG risks in the portfolio, the Betterworld team divested from TD in early 2024, due to anti-money laundering (AML) concerns, which the team views as a very material ESG issue for banks. While the team favors engagement as a first option, it is willing to divest from companies which do not meet its ESG standards for portfolio inclusion.

- The team added Kurita Water, a leading player in the water treatment industry, to its portfolio in mid-2024. Kurita has significant market share in water treatment, with chemicals, facilities and maintenance contracts across markets including Japan, Mainland China, South Korea, Southeast Asia, and Europe. With its solutions in ultrapure water supply, precision tool cleaning and others, the company generates 40% of its revenue and 60% of its operating profit from customers in the semiconductor industry.

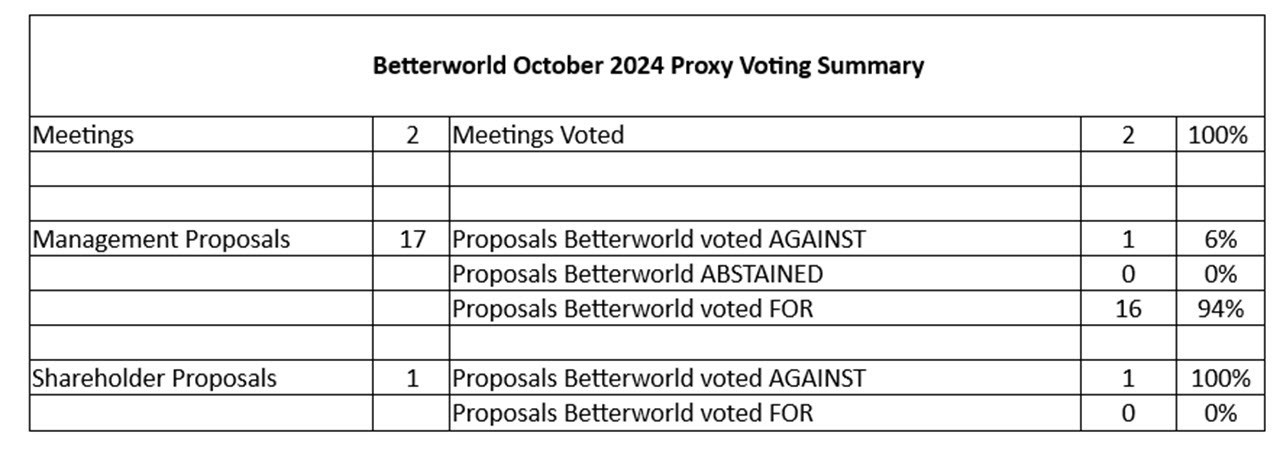

Proxy Voting

The Betterworld team participated via proxy in 2 company meetings with Dutch payments firm, Adyen and US consumer packaged good firm, Procter & Gamble.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of October 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2024 Mackenzie Investments. All rights reserved.